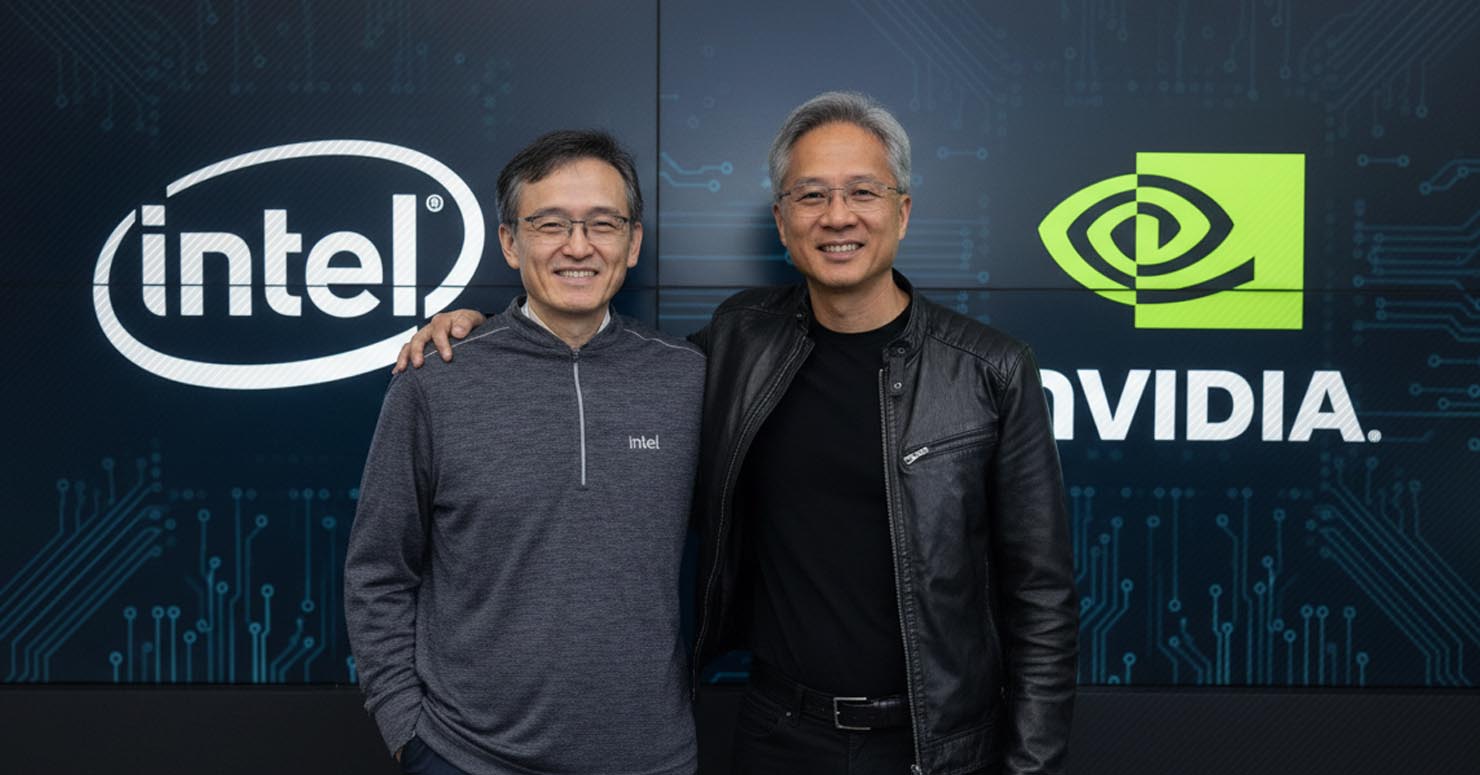

In a move that has sent shockwaves through the global technology landscape, Nvidia invests in Intel: a colossal $5 billion. This blockbuster deal, which was unthinkable just a few years ago, will see the two historic rivals join forces, with Intel’s burgeoning foundry business set to manufacture next-generation chips for Nvidia. This partnership is not just a business transaction; it’s a seismic geopolitical shift that fundamentally redraws the map of the semiconductor industry.

For decades, Nvidia and Intel have been fierce competitors. But the relentless demand for AI chips and the growing geopolitical risks surrounding Taiwan have forced a pragmatic and powerful alliance. As detailed in the initial report by Wccftech, this deal is a massive vote of confidence in Intel’s manufacturing capabilities and a strategic masterstroke by Nvidia to diversify its supply chain.

This detailed report by our Lead Tech Supply Chain Analyst, Hashim Haque, breaks down the motivations behind this historic deal, what it means for the current king of chipmaking, TSMC, and the broader implications for the global tech supremacy race.

The Core of the Deal: A Bet on Intel Foundry Services (IFS)

The $5 billion investment from Nvidia is a direct injection into Intel Foundry Services (IFS), the division of Intel that manufactures chips for other companies. This is a key part of Intel CEO Pat Gelsinger’s ambitious plan to reclaim the company’s former glory as the world’s undisputed leader in semiconductor manufacturing.

For Nvidia, this is a strategic necessity. Currently, the company relies almost exclusively on the Taiwan Semiconductor Manufacturing Company (TSMC) to produce its world-leading AI GPUs like the H100 and B200. While TSMC’s technology is second to none, having a single point of failure located in a geopolitically sensitive region like Taiwan is a massive risk for a trillion-dollar company.

By investing in Intel’s US-based foundries, Nvidia achieves several key goals:

- Supply Chain Diversification: It secures a second, high-volume source for its most critical products.

- Geopolitical Hedging: It reduces its exposure to potential disruptions in the Taiwan Strait.

- Access to US-Based Manufacturing: It aligns with the goals of the US CHIPS Act, potentially unlocking further government incentives and strengthening its position within the American tech ecosystem.

This move to secure its manufacturing future is a classic example of the strategic thinking that has propelled so many tech startups into global giants.

A Wake-Up Call for TSMC

This deal is a direct challenge to the dominance of TSMC. For years, the Taiwanese giant has been the only foundry capable of producing the most advanced chips at scale, giving it immense power over the entire tech industry. The Nvidia-Intel partnership is the first credible threat to that monopoly.

While Intel’s technology has historically lagged behind TSMC’s, the company’s aggressive roadmap, backed by billions in US government funding, aims to close that gap by 2026. Nvidia’s investment is the strongest endorsement of that roadmap yet. It signals that a major customer believes Intel can deliver on its promises. This will undoubtedly force TSMC to react, potentially leading to more competitive pricing and an acceleration of its own plans to build foundries in the US and Europe.

The Bigger Picture: The Geopolitics of Silicon

Beyond the corporate implications, this partnership has a massive geopolitical dimension. It is a clear victory for the United States’ industrial policy, which aims to bring critical semiconductor manufacturing back to American soil. A strong, revitalized Intel, backed by a key partner like Nvidia, is central to the US strategy of ensuring its long-term technological leadership and reducing its dependence on Asia.

This deal will create a powerful new “All-American” semiconductor axis, a development that will be watched closely by policymakers in both Europe and China. It is a fundamental realignment of the global supply chain, driven by the new realities of the AI era and the escalating tech rivalry between the US and China.

Frequently Asked Questions (FAQ)

1. Why is Nvidia invests in Intel, a rival?

Nvidia is invests in Intel’s chip manufacturing division (Intel Foundry Services) to diversify its supply chain. It’s a strategic move to secure a US-based manufacturing partner and reduce its heavy reliance on Taiwan’s TSMC, mitigating geopolitical risks.

2. What is Intel Foundry Services (IFS)?

IFS is a business unit of Intel that offers its semiconductor manufacturing services to other companies. It is a key part of Intel’s strategy to compete with foundries like TSMC and Samsung.

3. Does this mean Nvidia will stop working with TSMC?

No. Nvidia will almost certainly continue to use TSMC for a significant portion of its production, as TSMC is still the current technological leader. This deal is about creating a strong second source, not replacing the primary one, at least in the short term.

4. How does this affect the average consumer?

In the long term, a more competitive foundry market could lead to more stable supply and potentially more competitive pricing for high-end electronics like graphics cards and AI accelerators. It also strengthens the US tech industry, which has broad economic implications.