For any Indian traveling abroad, managing money has always been a major headache dealing with currency exchange, high credit card fees, and the constant fear of carrying too much cash. That era is quickly coming to an end. India’s revolutionary Unified Payments Interface (UPI) has officially gone global, with UPI international payments now live in seven countries. This is a game-changing development that allows Indian travelers to pay directly from their bank accounts, just like they do at home.

This isn’t just about convenience; it’s a fundamental shift in how cross-border payments work, putting India’s homegrown FinTech solution on the world stage. The dream of seamless UPI international payments is now a reality for millions.

This guide breaks down exactly how it works, which countries are on the list, and why this is such a massive deal for every Indian traveler.

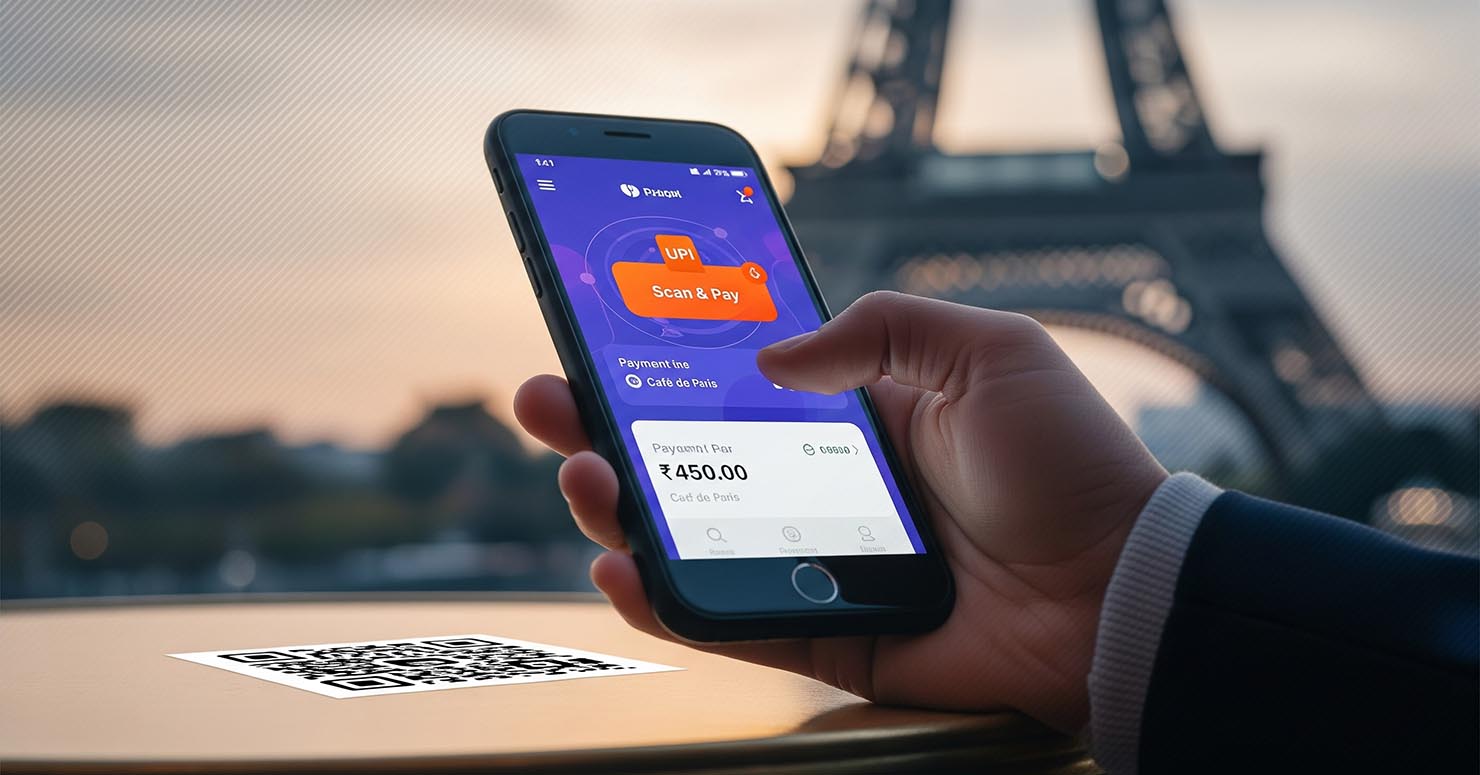

How It Works: The Magic of “Scan and Pay” Abroad

The beauty of the system is its simplicity. You don’t need a new app or a special international card. If you use apps like PhonePe, Google Pay, or Paytm in India, you’re already set up for UPI international payments.

The process is as simple as it is at home:

- Look for a QR code at a merchant that supports UPI.

- Open your preferred UPI-enabled app on your phone.

- Scan the QR code.

- Enter the amount in the local currency. Your app will automatically show you the equivalent amount in Indian Rupees (INR) based on the day’s exchange rate.

- Enter your UPI PIN to approve the transaction.

The money is debited directly from your linked Indian bank account. It’s a seamless experience that eliminates the need for currency conversion or swiping a physical card. This move is part of a larger trend of making travel easier through technology, similar to how the upcoming iPhone 17 going eSIM-only will simplify global connectivity.

The Official List: 7 Countries Where You Can Use UPI

According to the National Payments Corporation of India (NPCI), the body behind UPI, the service is now officially live in seven countries. This list is constantly growing, but as of now, you can use UPI international payments in:

- France: Starting with the iconic Eiffel Tower, the service is expanding to more merchants.

- UAE: A major destination for Indian tourists and professionals.

- Mauritius: Popular for tourism and with a large Indian diaspora.

- Sri Lanka: India’s close neighbor.

- Singapore: A key hub for business and travel in Southeast Asia.

- Bhutan: The first country to adopt UPI standards.

- Nepal: Another close neighbor with strong economic ties.

This network was established by NPCI’s international arm, NIPL, which has been making strategic partnerships around the globe, as detailed in their official press releases.

The Bigger Picture: India’s “FinTech Diplomacy”

This expansion is more than just a convenience for tourists; it’s a powerful act of “FinTech diplomacy.” India is actively exporting its highly successful digital public infrastructure to other nations. By creating a cross-border network for UPI international payments, India is:

- Strengthening Economic Ties: Making trade and tourism easier with partner countries.

- Challenging Global Payment Networks: Creating an alternative to the dominant Western payment systems like Visa and Mastercard.

- Boosting the Rupee: Facilitating direct conversion and settlement in its own currency.

This strategy showcases India’s growing power in the world of technology and finance. As global tech events like the confirmed iPhone 17 launch date draw international attention, having a robust payment system like this further cements India’s position as a major player. The ability for a system to process information and transactions seamlessly, whether it’s an iOS 26 AI summary or a cross-border payment, is the hallmark of modern tech leadership.

Frequently Asked Questions (FAQ)

1. Do I need to do anything to activate UPI international payments?

For most UPI apps, you simply need to activate international transactions through the app’s settings before you travel. The process is usually very straightforward.

2. Are there any fees for using UPI internationally?

While UPI payments eliminate many of the high fees associated with international credit cards, your bank may still charge a small currency conversion markup. However, this is generally much lower than traditional forex fees.

3. Is there a limit on how much I can spend?

Yes, there are limits on UPI international payments, which are governed by the regulations of the Reserve Bank of India (RBI) under the Liberalised Remittance Scheme (LRS). Check with your bank for the specific daily and annual limits.

4. Can I use UPI to pay anyone, or only at specific shops?

Currently, you can use UPI to pay at merchants that have enabled UPI or QR code-based payments through their local payment system that has partnered with NPCI. Person-to-person transfers are generally not supported yet.